How to Register a BOI Company in Thailand

A BOI company registration is a good option for those looking to establish a business in Thailand. This type of business can offer many advantages. Learn how to create a BOI Thai company and what the process involves. Additionally, you’ll know about the application procedure, the Target industries, and Accounting requirements.

Benefits of registering a BOI company in Thailand

Numerous incentives are available for companies who register as BOIs. Over Thailand BOI company , the tax burden of business activities is reduced by 70 percent. Companies that are located in one of the key investment zones outlined by the BOI are exempt from import duties on raw materials. In addition, companies can be exempt from the cost of water, electricity, transportation and infrastructure installation costs. Additionally, tax-free privileges could be for companies, such as the ability to recruit foreign skilled workers, without having four Thai employees. Companies that are BOIs also benefit from 100% foreign ownership and expedited visa processing.

A BOI company must also have a set amount capital. This amount is known as the registered capital. A company must have at minimum THB 250,000 of authorized capital in order to be registered. To register, the company must also pay fees to the government.

Application process

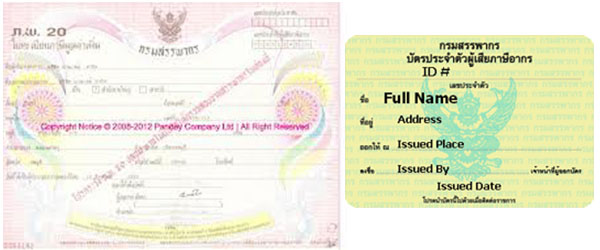

Complete the required applications forms to begin an BOI company in Thailand. These forms are available at the BOI headquarters in Bangkok or via several e-investment platforms. They range from eight to ten pages long and contain several questions pertaining to the nature of the business as well as its potential investors, clients, and shareholders. Once completed, the form is required to be submitted to the BOI along with the required documents and fees.

Once you have received all the required documentation The next step is to apply for the licenses and permits. A foreign-owned firm must get a Foreign Business License in Thailand within 60 days of incorporation. Additionally, it must register for VAT within 30 days of the business’s annual revenue exceeding 1.2 million THB.

Accounting requirements

There are certain accounting standards that you must meet in order to start an BOI business in Thailand. First your investment capital must not exceed 1 million Baht. The amount could be in physical assets, cash or a combination of both. Avoid using the value of the land, payroll budgets or production costs as investment capital.

Another crucial requirement is that your business must add a minimum of 10% value to the product you manufacture. If you sell coconuts, for instance you have to add 10 percent to the value of the product. You also have to pay an amount of 1.5 million dollars annually to your IT personnel. For manufacturers, you need to be approved by the relevant government bodies for your equipment and processes.

Target industries

BOI Thailand targets industries that offer competitive incentives in the region. In order to draw investors, BOI has developed a special tax incentive package to encourage the development of specific industries. Companies from abroad who work in the designated districts of Thailand are eligible for a personal income tax rate. This is one of the lowest rates in the ASEAN region. This incentive package includes tax holidays for up to eight years as well as five years of tax reduction. The government offers a one-stop service center for foreign investors, which eases the process of applying by providing helpful information and permits. In addition the Board of Investment has prepared special investment incentives for investors who invest in the Eastern Special Development Zone, which has been endorsed in principle and endorsed by the government.

BOI approved measures to boost investment in specific industries, and expanded its program to include digital technologies. The new measures are designed to encourage foreign investment and help Thailand improve its industrial competitiveness, overcome its resource constraints and explore new business opportunities. Thailand’s overseas investment is lower than other countries in the region. One of the most significant initiatives that was approved by BOI is the 50% corporate income exemption during five years for new digital technology projects. To be eligible for this incentive it is necessary for a project to make an investment of 1 billion baht in the first 12 months following approval. This additional tax incentive is accessible from January 4th, 2021 to the 30th day of December 2021.